Bye-Bye Mortgage

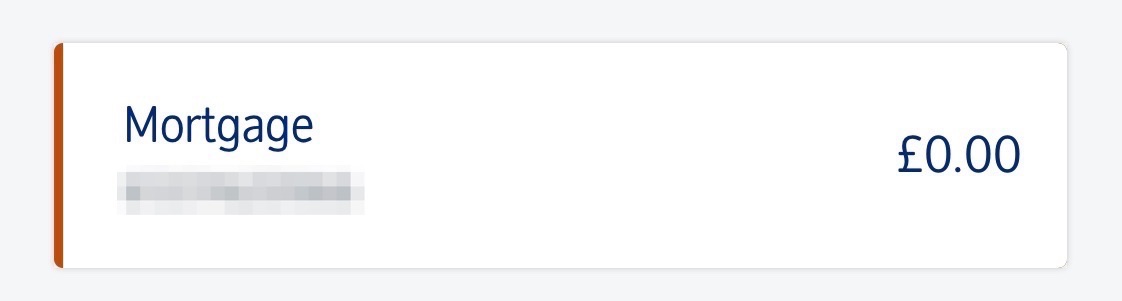

Fourteen years, five months, two weeks and six days after moving into our flat, this is the state of our mortgage:

Yup, those are all zeros, and they're real. No image fudging or site hacking. We made the final payment on our mortgage on the morning of 31 July 2018 thus completely paying off our mortgage, over ten years early and before either of us turning forty.

So how did we do it? Overpayment, overpayment and more overpayment, every month for neigh on ten years. No massive windfalls or inheritances or gifts from rich uncles came into play.

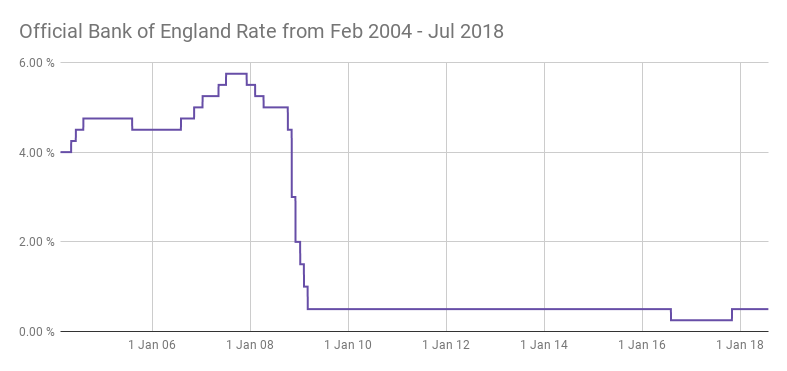

When we bought our flat, we agreed we'd get something we could both afford to pay our share, equally, on a monthly basis. As time went on, both of us earned more so the monthly mortgage contribution became less of a burden. Then the 🍑 fell out of the global finance industry and the Bank of England dropped the interest rate from 5.75% down to 0.5% in the space of just over a year.

Our mortgage rate was pegged at no more than 2% above this rate so it plummeted too. When it stopped plummeting we started over paying a few extra hundred pounds a month and built this up to £500 and we stuck to overpaying by £500 a month for many years. A few years ago we bumped this to £600. At first we used these overpayments to reduce our monthly payments but changed it to reduce the term instead when our overpayments became larger than our actual mortgage payments.

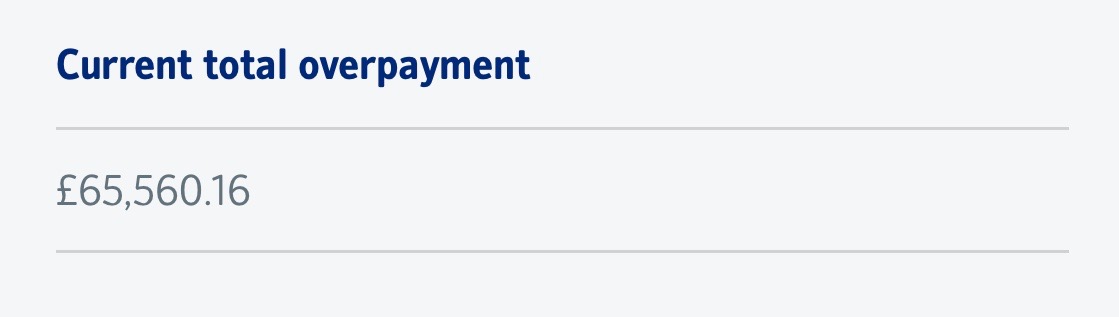

In the end we ended up over paying by £65 560.16:

That's more than half the amount of our original mortgage!! 😯

So now we're 100% debt free. Neither of us has a loan and now we don't have a mortgage either.

So what are we going to do with the money we're saving? Save some, spend some, travel and one day buy a house with a dog.